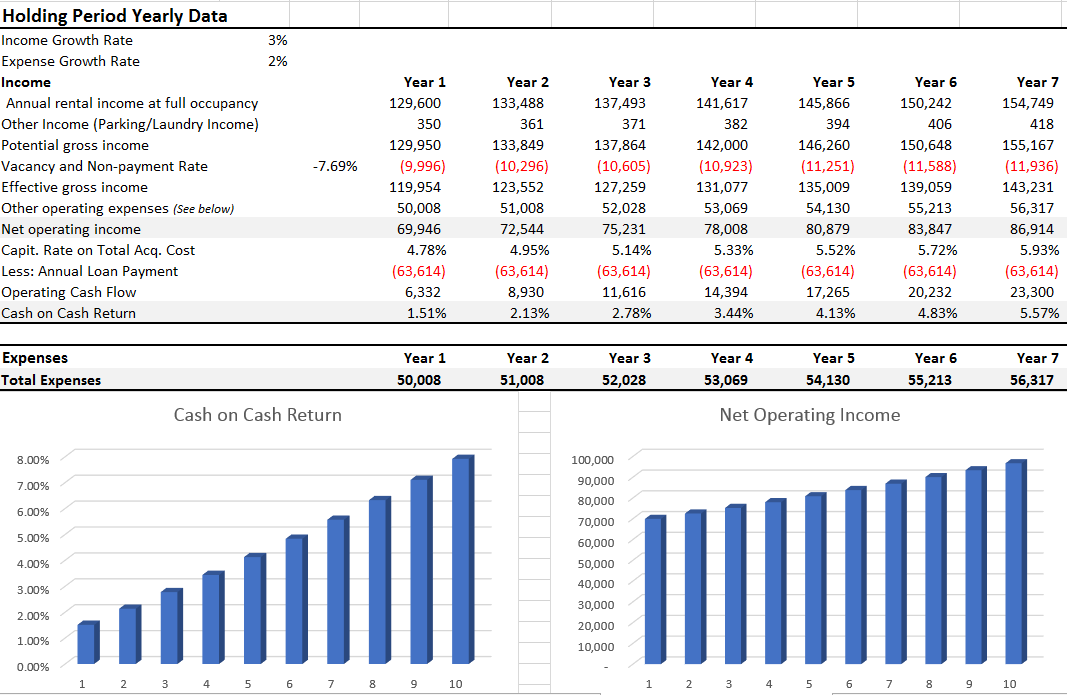

It can also be useful for an investor who owns several properties and is looking to unload the one whose operating costs leave the least amount of room for profit.įirst off, before buying real estate property, investors calculate the NOI to determine if it’s a good investment. As such, NOI can help an investor compare different properties to see which has the most potential. Net operating income is essential in helping investors determine a property’s capitalization rate, which is the rate of return on an investment property based on the income that it’s expected to generate.

Stabilized noi calculation plus#

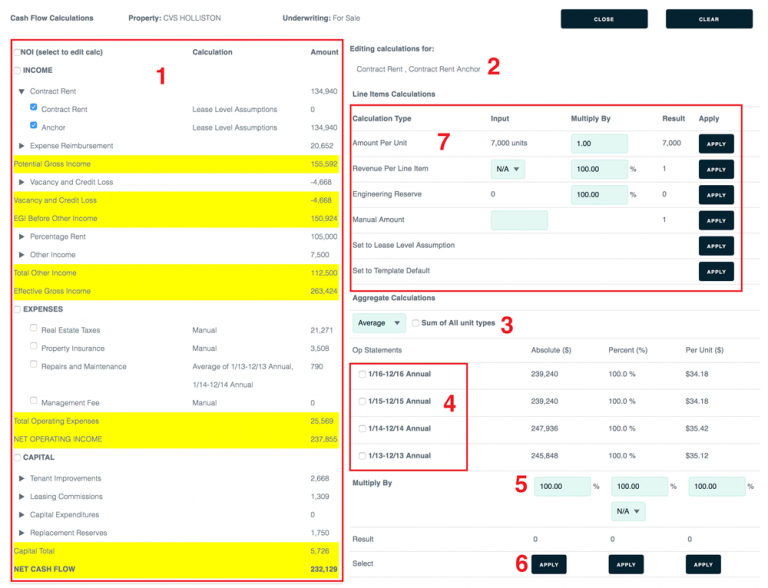

Regardless, the generally accepted net operating income formula is your potential rental income plus any additional property-related income minus vacancy losses minus total operating expenses. They will include property taxes, property insurance, management fees, utilities, advertising costs, accounting fees, legal fees, licenses, and other expenses. Operating Expenses include all cash expenses paid to keep the property running at maximum efficiency. From the Gross Operating Income you subtract the property’s Operating Expenses to arrive at the Net Operating Income. It does not take principal and interest payments, capital expenditures, depreciation, or amortization into consideration. It’s important to compare a property’s NOI components with those of competing properties in the same neighborhood. For example, operating margin, which is the potential rental income divided by NOI, can be directly compared across similar properties.

It equals all the revenue from the investment property minus all reasonably predetermined and necessary operating expenses.įinancing and income tax considerations are divorced from NOI, which makes it a good measure for assessing how well a property is being managed.

Stabilized noi calculation series#

Net operating income (NOI) is a series of calculations used to determine the feasibility and profitability of income-generating real estate investment properties. NOI is also used to calculate the net income multiplier, cash return on investment, and total return on investment.

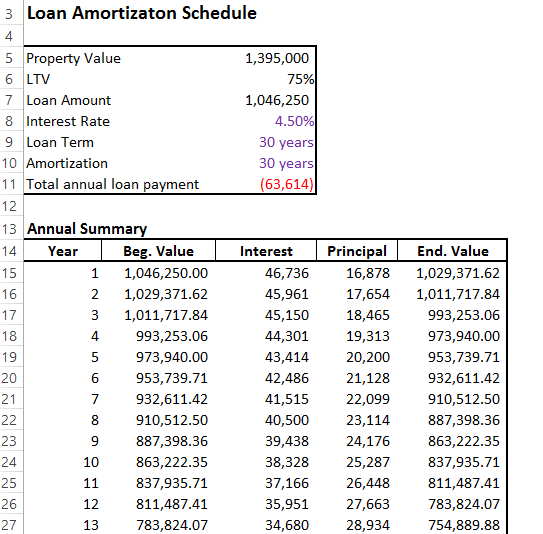

There are many ways to use the net operating income formula as a real estate investor.įor financed properties, NOI is also used in the debt coverage ratio (DCR), which tells lenders and investors whether a property’s income covers its operating expenses and debt payments. For example, if you pay $1 million for an investment property with an NOI of $100,000, then the cap rate is 10%.

0 kommentar(er)

0 kommentar(er)